Digital investment playbook for the bold

Build financial confidence with Wealthbold

Wealthbold teaches you the principles of portfolio-building, empowering you with financial confidence.

3 Steps to Financial Confidence

1. Learn with a Playbook

Gain insights into diversified portfolio-building with our easy-to-follow playbooks. Explore sample portfolio structures and learn key principles behind effective financial planning.

2. Understand ETF Basics

Get familiar with how exchange-traded funds (ETFs) work and their role in a diversified financial approach.

3. Maintain a Balanced Portfolio

Discover best practices for reviewing and adjusting your financial approach over time.

Time-Tested Portfolio Principles

Our playbooks break down the fundamentals of building a diversified portfolio. Historical data suggests that diversification can help manage risk and provide greater financial stability over time.

People Love Wealthbold

Wealthbold offers short, easy-to-follow playbooks on financial literacy. I finally feel confident understanding how to structure my savings!

– Boris

Like Boris, you too can gain financial confidence.

Pricing at a Glance

A one-time fee of 99,99 EUR (inc. VAT, if applicable).

Partners

FAQ

What is Wealthbold?

Wealthbold offers investment playbooks that teach you the principles of portfolio-building, empowering you with financial confidence.How does Wealthbold work?

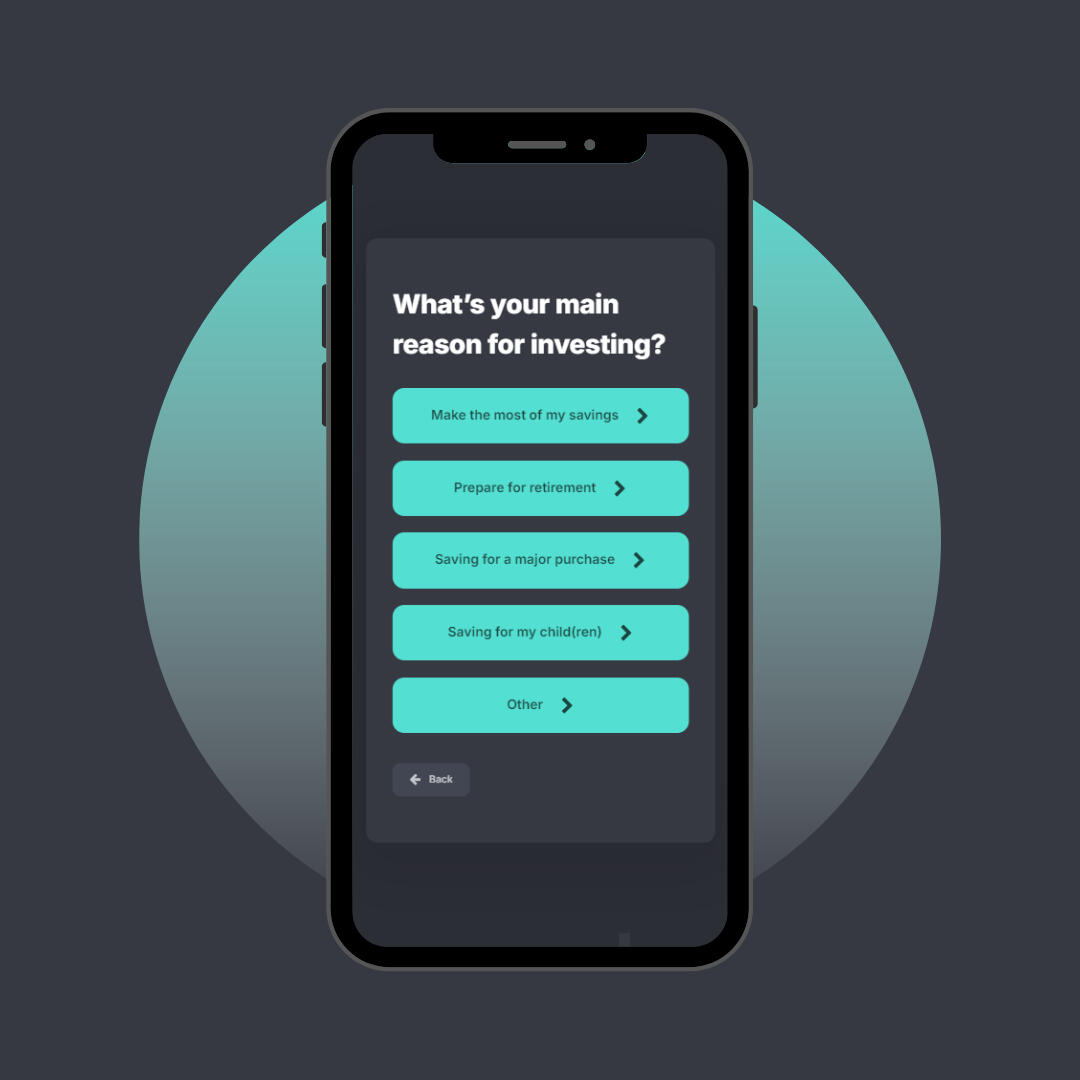

Answer a few simple questions and receive a playbook. The playbook provides insights into portfolio-building principles and explains key concepts of diversification and asset allocation.What is a playbook?

A playbook is a structured guide that breaks down financial concepts into easy-to-understand steps. It’s designed to help you quickly grasp key ideas related to financial planning.What is the methodology behind the playbooks?

The playbooks introduce time-tested financial principles and explain how diversification can help manage financial uncertainty. While market fluctuations are normal, historical data suggests that a balanced approach can help reduce volatility over time.What should you do during market downturns?

Financial markets experience ups and downs. With a focus on long-term financial understanding, the playbooks offer guidance on maintaining confidence during periods of uncertainty.How much does Wealthbold cost?

There is a one-time fee of 99,99 EUR (inc. VAT, if applicable).If you don’t enjoy your playbook, can you get a refund?

Yes. If you’re not satisfied, get in touch at [email protected] within 30 days, and Wealthbold will issue a refund.